International markets experienced significant market volatility recently. China, the United States and Europe engaged in escalating trade disputes, which caused investors and businesses and policymakers to express deep concern. The fast-paced sequence of tariff announcements and export control enhancements and supply chain interruptions has produced extreme market volatility, which makes every market update capable of triggering substantial price changes in stocks and commodities and currencies.

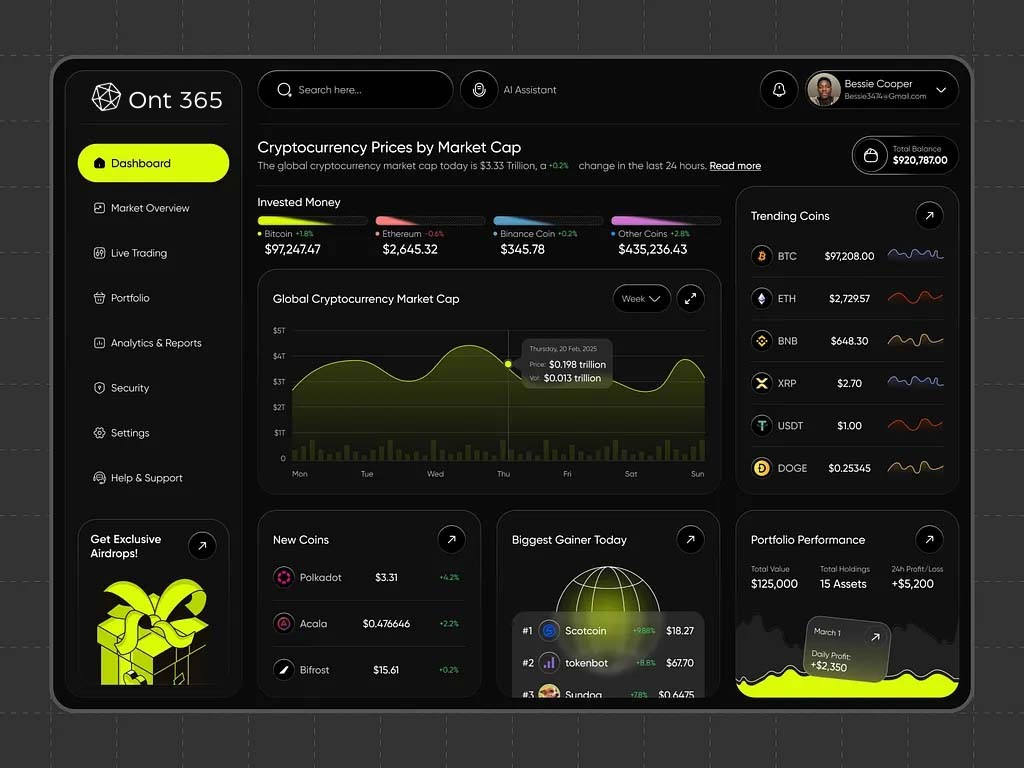

The European trader chose to take a different approach than other investors, who chose to wait for official statements and complete economic reports before making their moves. The trader used Ont 365 to convert market volatility into valuable market information which he could use to generate profits through his trading activities.

Via its real-time market data and scenario simulation and analytical dashboards, the platform enabled him to detect upcoming market changes in various industries. Because of that, he could take advantage of them before the general market reacted. So, the trader who took charge of his investments during this week of political instability protected his assets while demonstrating how technology enables traders to handle challenging market conditions effectively.

When Tariffs Shake the Market: A Trader’s Real Test

The market experienced immediate changes when the government announced it would impose tariffs on electronic products and rare earth materials. It experienced factory shutdowns and delivery interruptions and cost increases, which generated widespread investor uncertainty about their investment strategies. The European technology sector displayed early indicators of market instability, which the 34-year-old Frankfurt-based trader detected during the market crisis.

Through “Trading Platform’s” real-time dashboards, he monitored stock and commodity price changes which indicated developing trade conflict risks. The trader used simulation techniques to predict tariff effects on different market segments before official news announcements reached the public. His forward-thinking investment approach enabled him to adjust his portfolio and achieve profits before the general market adjustment.

His trading method gained rapid popularity among market participants who followed him through online financial platforms. The trading community expressed surprise about how this individual trader achieved analysis results that matched those of professional market experts.

From Headlines to Hands-On Strategy

His ability to use data in a disciplined manner made him stand out from other investors. Via the Ont 365 he merged real-time market information with supply chain updates and news specific to particular sectors to generate investment decisions. He explained to financial podcast listeners that global events occur rapidly, but traders need to identify hidden patterns to discover profitable opportunities.

The way traders transform news into executable investment plans represents a fundamental transformation in their trading methods. The modern trader uses real-time analytics to make immediate trading decisions, whereas traditional investors based their decisions on weekly or monthly reports.

Turning Global Disruption into Daily Decisions

Multiple industries revealed their supply chain weaknesses through the trade disputes which occurred between the US and China and Europe. The market experienced significant price increases for commodities, while technology stocks experienced wild price swings and currency exchange rates made rapid changes. The Frankfurt trader treated these market developments as essential indicators which directed his investment decisions.

Through Ont 365 he executed scenario-based models to forecast how upcoming trade tariffs would affect particular businesses and their respective industries. The trader developed emergency plans which would activate when China imposed export limitations or when Europe implemented new import regulations. Through his ability to convert political instability into quantifiable data, he successfully took control of his risks.

The Value of Real-Time Market Insight

Trading in the modern market requires traders to predict market movements instead of simply responding to news headlines. The instant spread of political announcements and trade decisions and supply chain disruptions now creates immediate market effects worldwide. The Ont 365 system enables traders to make swift decisions through its combination of scenario modeling and sector analysis and real-time market monitoring.

The trader quickly evaluated which stocks would face the most risk when European technology export tariffs became a subject of discussion. The trader executed a portfolio adjustment through which he protected vulnerable companies and expanded his investments in sectors that would gain from the situation. His early market response allowed him to defend his investments while gaining market leadership.

The way investors behave has evolved because traders now actively seek to understand global events through real-time data analysis instead of waiting for official reports. Investors use real-time global data to make decisions with complete confidence.

Tools That Convert Uncertainty into Action

The Frankfurt trader’s experience demonstrates why modern analytical platforms remain essential for trading operations. The Ont 365 system combines data from commodities and equities and currency pairs and trade-sensitive sectors for analysis. Users can test different scenarios while tracking market changes and create investment plans without exposing their actual money to risk.

Private investors now use these platforms to handle international events in their trading activities. Users without access to exclusive information can study market responses and create forecast-based plans, which enable them to enter the market before general market participants detect trends.

Moreover, the trader achieved success through his disciplined approach combined with appropriate analytical tools, which enabled him to match institutional analyst performance during market volatility.

His trading experience showed how preparation creates a psychological benefit for traders. His prepared strategies for different market situations helped him stay calm during panic moments, while he successfully exploited market changes. The ability to control market conditions enables users to convert unpredictable situations into organized decision-making systems.

A New Era for Private Traders

The ongoing trade disputes between China and the US and Europe create difficulties for businesses and investors across the world. The Frankfurt trader story demonstrates how financial markets have undergone substantial changes. The combination of Ont 365 tools enables people to track and respond to worldwide events at speeds comparable to those of governments and large institutions.

The financial industry is not the only sector that will experience changes because of this development. Real-time analysis and scenario planning and adaptive strategies have become essential for businesses and small investors and educational programs. The Platform enables users to track market volatility while creating predictive models which help them make better investment choices from international trade unpredictability.